Stock Market Algorithmic Trading Software

Gain the ability to quickly test and improve your trading strategies to find the best entry and exit points. NO Coding Required.

How Stock Algorithm Trading Works with Build Alpha

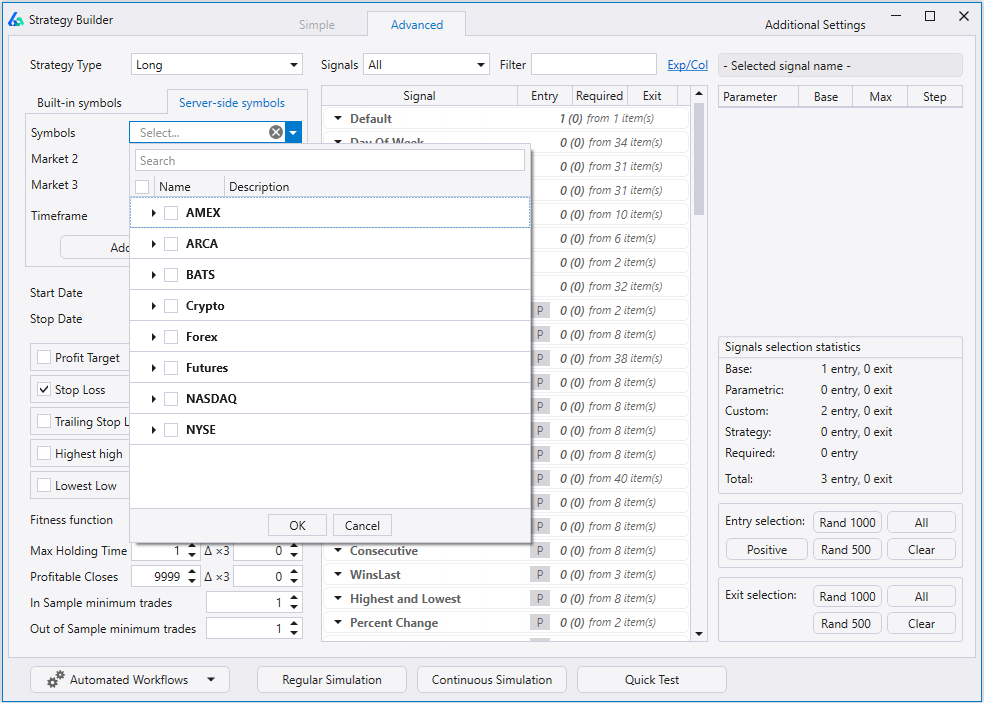

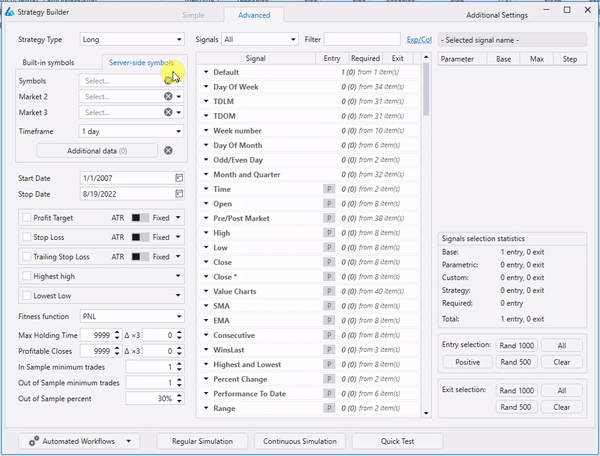

Step 1 – Choose the symbol or symbols for which you want to build your trading strategy. If you select a single symbol, then Build Alpha will return the best strategies for that symbol. If you choose a basket of symbols, then Build Alpha will return the best trading systems that work across that basket.

Step 2 – Choose your entry and exit signals. Build Alpha has 6,000+ entry and exit signals in the built-in library that cover just about everything you can think of for trading ideas. Here is a short list:

- Seasonality, time of day, day of week, month, quarter

- Price Action, Candlestick patterns, Chart Patterns

- Volume and Volatility Measures

- Technical Analysis and Technical Indicators

- Fundamental Analysis and Investment metrics

- Market Breadth, TRIN, Tick, Dark Pool Index

- Economic Events and Data such as GDP, Nonfarm payrolls

- Options Flows, Gamma Exposure

- Treasury Yields and Spreads

- Vix, Vix Term Structure

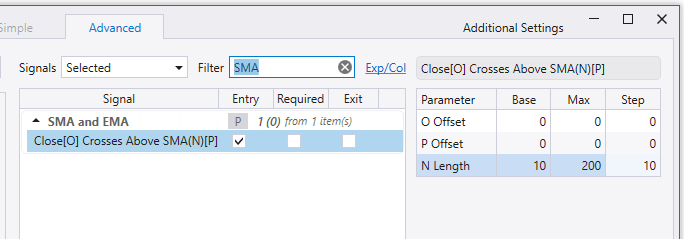

After selecting the entry and exit signals, you can also set parameter ranges for Build Alpha to optimize. This can help you find the optimal length or threshold to trigger a buy and sell order for any algo trading strategies the software creates.

The above would check Close crossing above the SMA with length from 10 to 200, incrementing by 10.

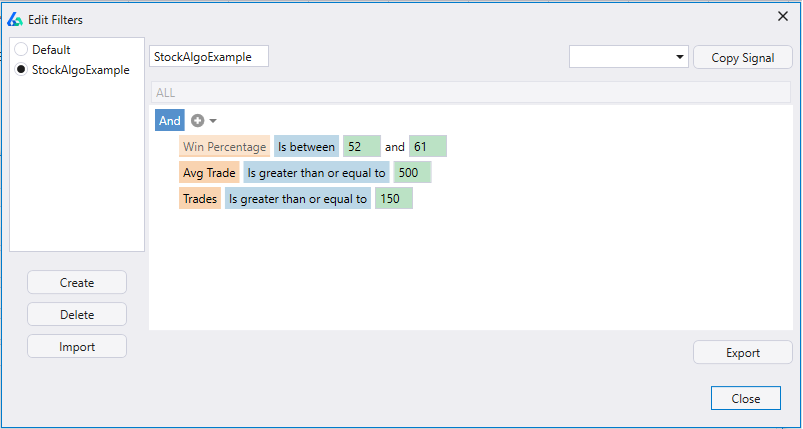

Step 3 – Set Filters so Build Alpha only returns the strategies you want. The trader can set filters for performance metrics of the strategies so that the automated trading software only returns acceptable algorithmic trading strategies.

Set filters for profit factor, drawdown, number of trades, winning percentage or even advanced options available for experienced traders. There are numerous built-in metrics to choose from.

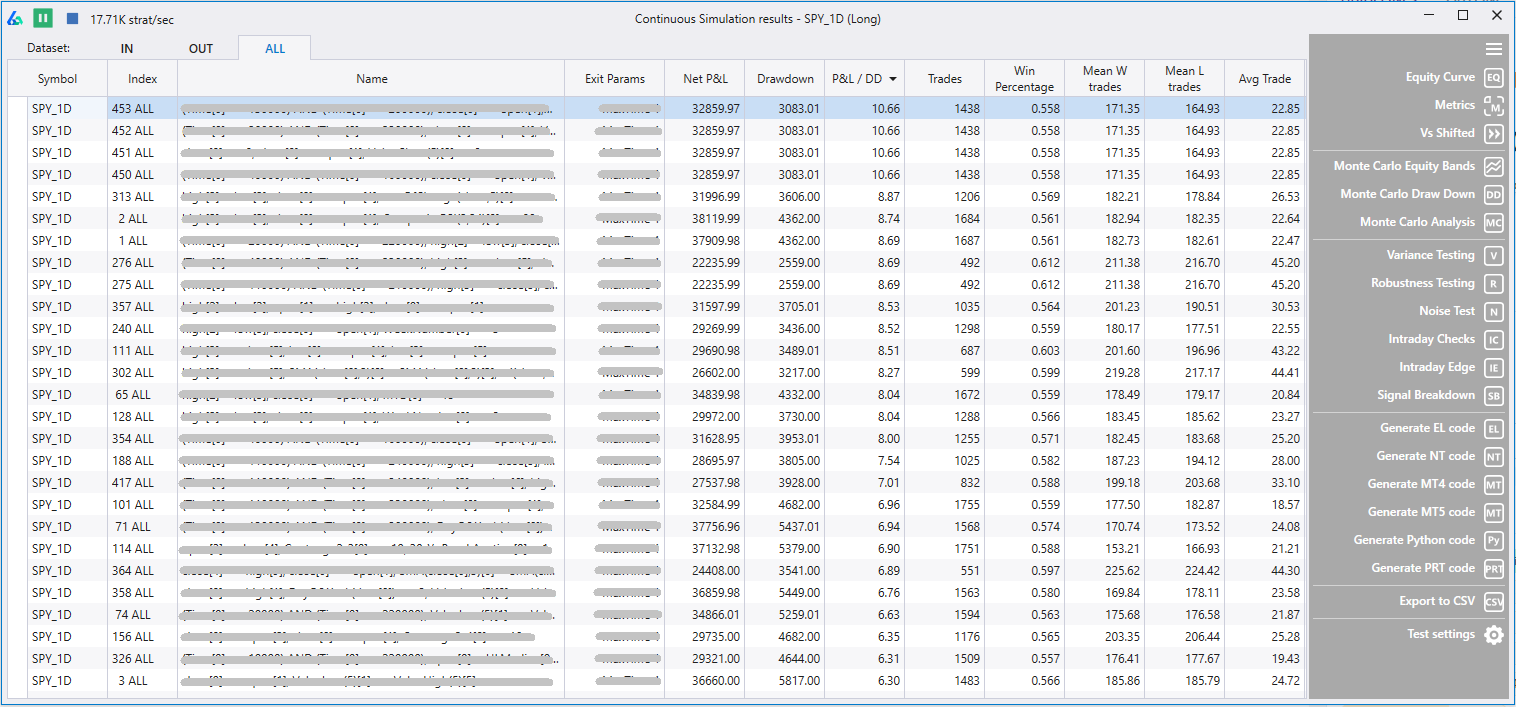

Step 4 – Hit Simulate. Build Alpha’s genetic algorithm will begin learning from your inputs, the historical data, and start building the best trading systems for you. This software uses machine learning to create and improve algorithmic trading strategies and will display the best results. The results window will continuously update with better strategies and can be paused or stopped at any time (in the upper left-hand corner).

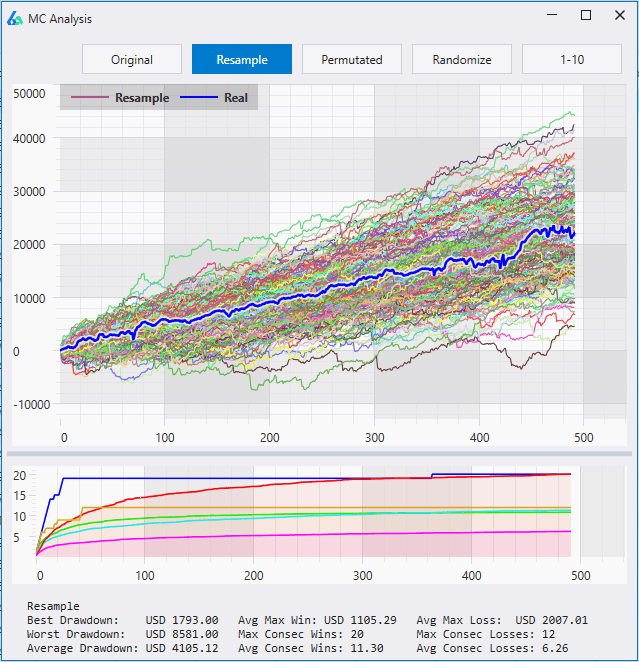

Step 5 – Analyze the Results and choose your top algorithmic trading strategy. Build Alpha is widely considered the best algorithmic trading software due to its large suite of professional stress tests and robustness tests. These validation methods help identify strategies that are more likely to continue their performance in the future.

To read more please visit the complete Robustness Testing Guide or the Monte Carlo Simulation guide.

Stock Trading Features

- Access to stock market data, all timeframes

- Pre and post market signals

- Choose time windows

- Ability to force end of day exits

- Advanced charting and automated technical analysis

- Quick Test Feature

Access to Stock Market Data

Build Alpha has access to all listed securities going back to 2006. This includes 1 minute data up to daily, weekly, monthly and any timeframe in between. This gives tremendous flexibility to test the exact trading strategies you want over a variety of market conditions.

Pre and Post Market Signals

Use pre and post market data and signals to build a better trading system. The trader can choose to only trade symbols that have above average pre-market volume or wait until the regular session price closes above the pre-market high, for example.

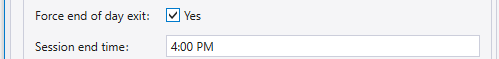

Time Windows and Force End of Day Exits

Add parameters to restrict trading to only certain time windows. Develop a trading strategy for the morning session and a separate strategy for the afternoon session. Restrict trading during the lunch hour lull.

Additionally, traders can activate the force end of day exit option in the settings menu which forces every strategy to close positions at the pre-determined time. This enables day traders to take no overnight risk with algorithmic trading.

advanced Charting and Automated Technical analysis

Build Alpha’s new portfolio mode allows traders to monitor saved strategies in real-time, view the trades appear on charts, and add indicators. These trading tools are not always necessary for algorithmic trading, but nice to have for visual traders transitioning to a more data driven style.

All chart patterns are available such as head and shoulders, bull flags, pennants, wedges, and more. These can be used as entry or exit signals as well as displayed on live charts.

For instance, a trader could test how the ascending triangle pattern does with a 2 ATR stop and 2.5 ATR profit across all Nasdaq stocks. Check out the video below to see how in less than 15 seconds.

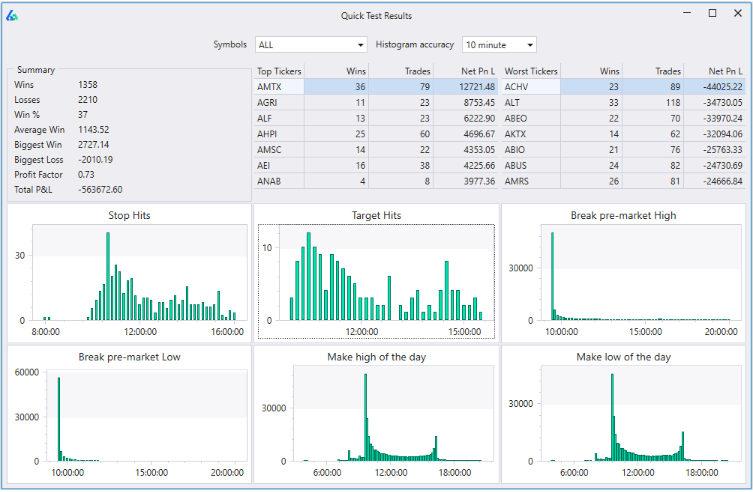

Quick Test | Best Algorithmic Trading Platform

Want to know the best time to exit a position? Want to know what time most stocks break their pre-market high or low? How about what times your profit or stop losses are hit? These insights can help you modify your risk management or trading bot for more powerful trading backed by historical data.

Requirements for using Build Alpha

Build Alpha is a desktop software not a mobile app similar to other popular trading platforms like TradeStation, NinjaTrader, and MetaTrader. The automated software requires respectable computer specifications but nothing overwhelming. It is recommended to have

- Windows operating system (Mac can use virtual env)

- 8GB RAM

However, more RAM and more CPU cores will of course make Build Alpha able to achieve more and work faster.

Mac users can use Build Alpha with Build Alpha’s latest update or by using a windows virtual environment. Parallels is the community favorite, hands down.

Data and Broker Integrations with Build Alpha

Many traders opt to use the Build Alpha database subscription as it is much faster, reliable and professionally cleaned. Reminder that daily data is built-in and free. However, there is also the option to use existing data from providers or brokers account you already subscribe to as well.

For instance, Build Alpha can pull live data from the following sources

- TradeStation (learn how they will pay for your BA license)

- Interactive Brokers

- Quote Media

- Binance (for trading cryptocurrencies)

- Tradier (coming soon)

The live data allows stock and ETF traders to monitor live positions, P&L updates, view simulated automated trades, and track multi-asset portfolio management all in one algorithmic trading platform.

Build Alpha also supports crypto trading, currency pairs, futures, and all other financial markets. This means you can start trading with any data provider and monitor fully automated trading strategies across all asset classes in one trading platform.

Custom Signals and Indicators in Build Alpha

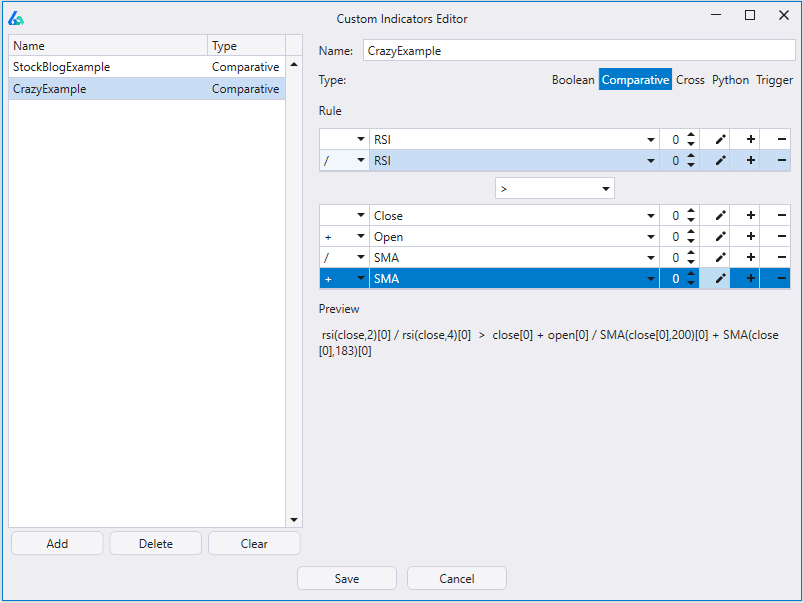

If you cannot find the signal you are looking for in the built-in signal library of 6,000+ signals, then you can build your own. There are two ways you can create custom indicators in Build Alpha.

The first and easiest way, is to use the custom builder or signal editor which requires no coding at all. Simply choose whatever indicators, comparison, math operators and parameter values to create your custom signal.

To show the flexibility of this indicator builder, here is an indicator that only trades when the 4-period Relative Strength Index (RSI) has closed below 12 at least 3 times in the past 5 days.

Another example is to have the 2-Period RSI divided by the 4-Period RSI be greater than the Closing Price + Opening Price divided by the 200-SMA + 183-SMA.

You get the point!

The second way to add custom signals to the algo trading engine is to use python. You can add custom entry and exit signals using python and pass them to the Build Alpha genetic algorithm, combine them with existing signals or extend them yourself. To read more about using Python in Build Alpha head here.

FAQ Section

What Stocks Can I backtest with Build Alpha?

Both listed and delisted securities. Custom stocks, pairs, and more. There are no limitations. Build Alpha can handle any country’s stocks and has options for multiple account currencies.

How Much Data does Build Alpha have?

The database subscription includes access to all symbols and asset classes with intraday data going back to 2006. If a symbol does not have this much history, then the database has as much as is available. There are no limitations and 2006 was arbitrarily chosen. Those with more data can always import and test on their own.

Can I Import my Own Data?

Yes, of course. Build Alpha accepts custom data in both text and csv format. Just need simple Date, Time, Open, High, Low, Close, Volume, Open Int. If you do not have any of the columns, then you can use dummy values like 0s.

Do you have Sample Trading Strategies?

Yes, there are sample strategies on the blog, private forum, and a starter pack of ten simple strategies. These are all meant to be simple building blocks and not something to blindly follow or do copy trading.

Can I add slippage and Commissions?

Yes, both are editable in the settings menu. You can adjust the fees to be per share or percentage of total volume as well as various options for position sizing, risk management and more.

Does this software allow for Intraday and Day Trading?

Absolutely. The database and software both support any timeframe of data. There are also unique features geared toward intraday traders.

- Custom time windows – require time of day you will allow algorithmic trading

- Force end of day exit – turn on or off forced end of day exits

- Intraday Edge Strategy Search – Look at daily strategies for profitable intraday windows

- Intraday Hidden Checks – test for max trades per day, max P&L per day, total trades, etc.

About Build Alpha

Build Alpha was created by David Bergstrom who has spent the last decade-plus in the professional algorithmic trading world working with high frequency trading firms, hedge funds and registered investment advisors (RIAs). Many of his experiences have led to a series of repeated processes to find, create, test and implement algorithmic trading ideas in a robust manner. This software is the culmination of this process from start to finish.